Table of contents

Quick Summary

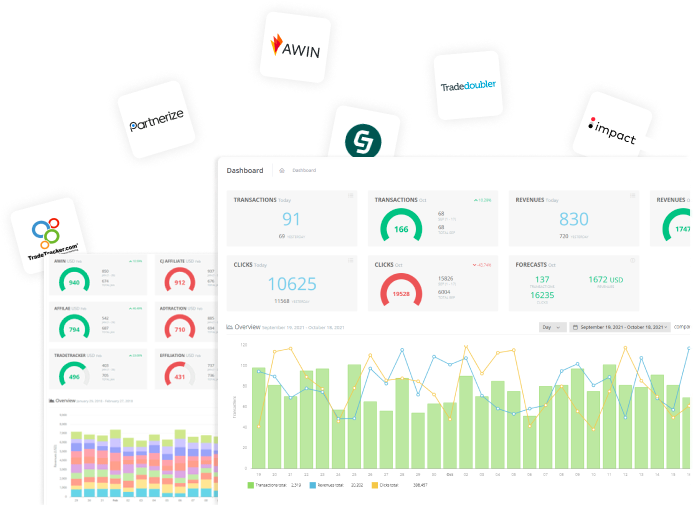

This guide highlights the top credit card affiliate programs, offering high commissions and potential recurring revenue. Choosing the right program can significantly boost your earnings. To optimize your efforts, Strackr’s platform provides easy management tools, helping you track and improve performance. Explore more strategies to maximize your affiliate revenue on our blog.

Looking for the Best Credit Card Affiliate Programs?

Finance is one of the most lucrative affiliate marketing niches, with significant yearly increases in affiliate earnings. This niche can be a gold mine if you know how to find programs that pay well and have compelling offers that you can pass on to your audience.

In this Strackr guide, we dive into the world of credit card affiliate programs and give you our top fourteen picks for the best programs out there in 2025.

Let’s dive in.

Why Listen to Us?

At Strackr, we’ve helped thousands of publishers like Capital Koala, Joko, and Mucho Group manage their affiliate programs and optimize their earnings. Our all-in-one dashboard makes it easy to track your performance, analyze data, and make informed decisions to maximize your revenue.

The bottom line? We’ve spent years in the affiliate marketing industry, and we know what programs work and which ones don’t.

What Are Credit Card Affiliate Programs?

Credit card affiliate programs are partnerships between credit card companies and affiliates (that's you!) where you promote credit card offers to your audience. In return, you earn a commission for each successful application or approval.

It's like being a matchmaker between credit card companies and potential cardholders.

These programs are a part of the broader affiliate marketing landscape, which has changed how businesses get customers online.If you're new to affiliate marketing, check out our comprehensive guide on getting started with affiliate marketing to get up to speed.

Why Is Choosing the Right Credit Card Affiliate Programs Important?

Let's be real – who doesn't want to boost their income?

Credit card affiliate programs offer some compelling benefits that make them worth your attention:

- High Commission Potential: Credit card offers often come with hefty commissions, sometimes reaching hundreds of dollars per approved application. Ka-ching!

- Recurring Revenue: Some programs offer ongoing commissions based on cardholder activity, creating a potential passive income stream. It's like planting a money tree that keeps giving.

- Valuable Content for Your Audience: By promoting the right credit cards, like Upgrade, you're providing genuinely useful information to your readers. It's a win-win situation.

For more insights on maximizing your affiliate income, don't miss our article on proven strategies to increase your affiliate revenue.

What to Consider When Choosing Credit Card Affiliate Programs

Before you jump in headfirst, here are some key factors to keep in mind:

- Relevance to Your Audience: Does the credit card offer align with your audience’s interests and needs? Make sure that the credit card’s features and benefits are what your audience is looking for.

- Commission Structure: See how much you will earn from each approved application. Also, look for competitive rates and recurring revenue potential.

- Reputation of the Card Issuer: Partner with trusted brands to maintain your credibility. Look up reviews and feedback on the card issuer, making sure that they have a record of paying commissions timely.

- Program Terms and Conditions: Pay attention to cookie duration, payment terms (including minimum payout thresholds and payment frequency), and any restrictions.

- Promotional Materials: Check if the program provides high-quality creatives and tracking tools.

Top 14 Credit Card Affiliate Programs to Consider

- Avianca LifeMiles Program

- Visa Affiliate Program

- Mastercard Affiliate Program

- Chase Affiliate Program

- American Express Affiliate Program

- Discover Affiliate Program

- Capital One Affiliate Program

- Experian Affiliate Program

- USAA Credit Cards Affiliate Program

- Credit Karma Affiliate Program

- Luxury Card Affiliate Program

- Credit Sesame Affiliate Program

- Indigo Platinum Mastercard Affiliate Program

- Owner’s Rewards Card by M1 Affiliate Program

1. Avianca LifeMiles Program

The Avianca LifeMiles Program is perfect for international travelers or digital nomads, especially those frequently flying to South America. It offers 0% APR for the first 12 months, no foreign transaction fees, and various travel protections.

Plus, it provides a profitable earning opportunity with up to $200 per referral.

Avianca LifeMiles Program specs:

-

Commission: Up to $200 per referral

-

Cookie Duration: 30 days

-

Payment Method: LifeMiles credit card affiliate program

-

Products: Avianca LifeMiles Credit Card

2. Visa Affiliate Program

As one of the biggest names in plastic, Visa's affiliate program offers a wide range of card options to promote. From cashback to travel rewards, there's something for everyone.

Plus, with Visa's global recognition, you're promoting a brand your audience already knows and trusts.

Visa affiliate program specs:

-

Commission: $25-$100 per approved application

-

Cookie Duration: 30 days

-

Payment Methods: Direct deposit, check

-

Products: Various Visa-branded credit cards from different issuers

3. Mastercard Affiliate Program

Mastercard's affiliate program lets you earn through card referrals, and appeals to audiences interested in unique experiences and luxury perks. With a strong brand reputation and a wide array of card options, their affiliate program is perfect for promoting products with more than just financial benefits, making it an attractive option for you to target high-end consumers.

One unique aspect? They focus on experiential rewards, which can be a great selling point for travel and lifestyle bloggers.

Mastercard affiliate program specs:

-

Commission: $30-$150 per approved application

-

Cookie Duration: 45 days

-

Payment Methods: ACH transfer, wire transfer

-

Products: Range of Mastercard-branded credit cards

4. Chase Affiliate Program

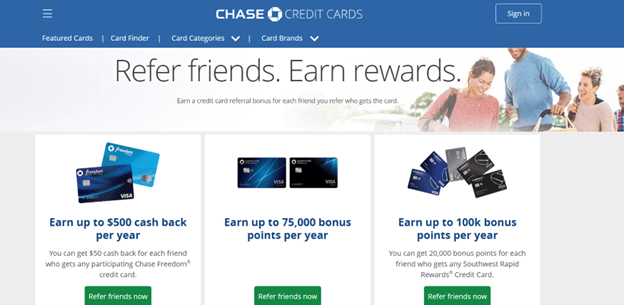

Chase's program is a favorite among many affiliates, and for a good reason.

Their Chase Sapphire Preferred and Reserve cards are like the Beyoncé of credit cards – everyone wants a piece of them. The program offers attractive commissions and a user-friendly interface.

Chase affiliate program specs:

-

Commission: $50-$200 per approved application

-

Cookie Duration: 30 days

-

Payment Methods: Direct deposit

-

Products: Chase Sapphire, Freedom, Ink business cards

5. American Express Affiliate Program

Amex's program is known for its luxury card offerings and generous rewards.

If your audience has champagne tastes and caviar dreams, this program could be right up your alley. Just be prepared for stricter approval requirements.

American Express Affiliate Program specs:

-

Commission: $25-$250 per approved application

-

Cookie Duration: 45 days

-

Payment Methods: Direct deposit, check

-

Products: Amex Platinum, Gold, Blue Cash cards

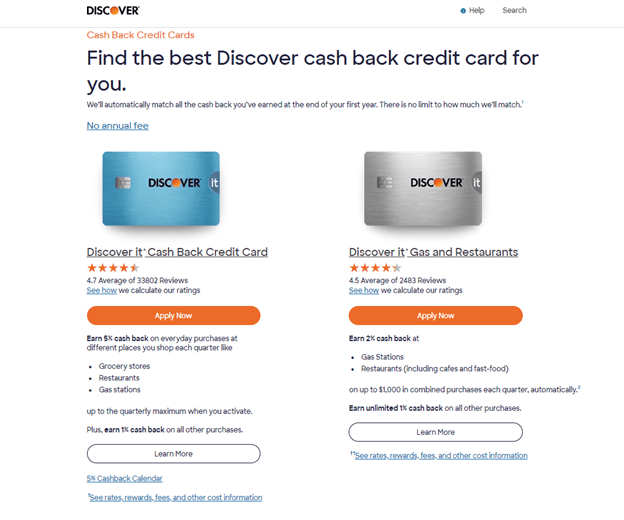

6. Discover Affiliate Program

Discover's program is perfect if you're targeting the cashback-loving crowd.

Their rotating 5% cashback categories are a major draw, and their affiliate program reflects this consumer-friendly approach with competitive commissions.

Discover Affiliate Program specs:

-

Commission: $50-$100 per approved application

-

Cookie Duration: 30 days

-

Payment Methods: Direct deposit

-

Products: Discover it Cash Back, Student, Secured cards

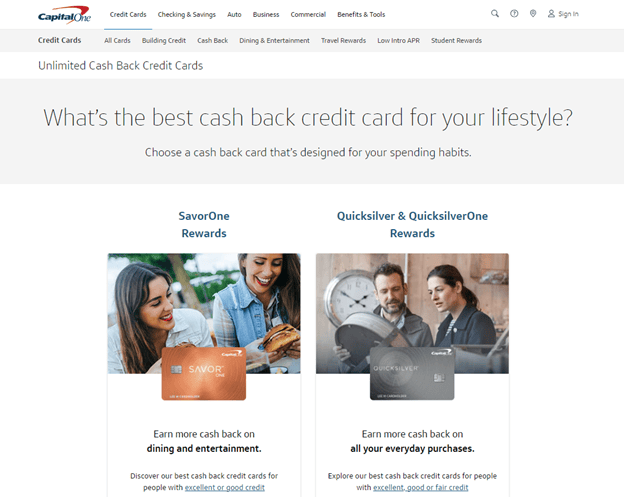

7. Capital One Affiliate

Program Capital One has been making waves with their travel rewards cards lately. Their Venture and Spark cards offer flexible rewards that appeal to both casual travelers and road warriors alike.

Their affiliate program mirrors this flexibility, with options for various publisher types.

Capital One Affiliate Program specs:

-

Commission: $50-$150 per approved application

-

Cookie Duration: 30 days

-

Payment Methods: Direct deposit, check

-

Products: Venture, Quicksilver, SavorOne, Spark business cards

8. Experian Affiliate Program

Experian offers credit monitoring and reporting services to help you manage and improve your financial health. It regularly updates you on your credit status, identity theft protection, and personalized recommendations to boost your credit scores.

This affiliate program lets publishers, bloggers, and websites earn revenue by promoting Experian's financial products and services, and is designed for those who regularly produce financial content.

Experian Affiliate Program specs:

-

Commission: Varies by program

-

Cookie Duration: 30 days

-

Payment Method: Experian affiliate program

-

Products: Credit monitoring, credit reports, identity theft protection, credit score improvement tools

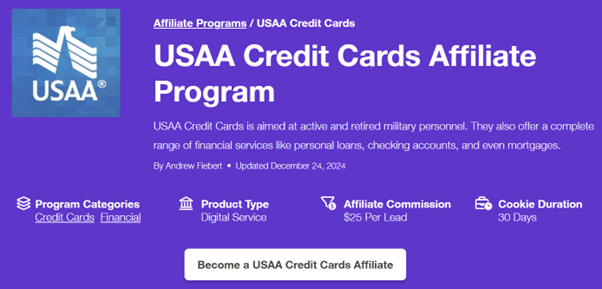

9. USAA Credit Cards Affiliate Program

USAA offers credit cards tailored for military members, veterans, and their families, featuring competitive rates and rewards. Affiliates can promote these products to a niche market, benefiting from USAA's strong reputation and commitment to the military community.

USAA Credit Cards Affiliate Program specs:

-

Commission: $25 per lead

-

Cookie Duration: 30 days

-

Payment Method: Bank transfers

-

Products: USAA-branded credit cards

10. Credit Karma Affiliate Program

Credit Karma provides free credit scores and financial tools to help users monitor and improve their financial health. Affiliates can earn commissions by promoting Credit Karma's services, leveraging its strong brand recognition and high conversion rates.

Credit Karma Affiliate Program specs:

-

Commission: Up to $6 per new signup

-

Cookie Duration: 30 days

-

Payment Method: Direct deposit

-

Products: Credit monitoring services, financial tools

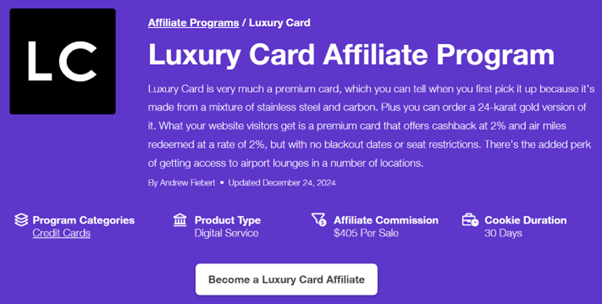

11. Luxury Card Affiliate Program

Luxury Card offers premium credit cards designed for affluent consumers, providing exclusive benefits such as 2% cashback, 24/7 concierge services, and luxury travel perks. Affiliates can earn substantial commissions by promoting these high-end cards to a discerning audience seeking top-tier rewards and services.

Luxury Card Affiliate Program specs:

-

Commission: $405 per sale

-

Cookie Duration: 30 days

-

Payment Method: FlexOffers platform

-

Products: Luxury Card-branded premium credit cards

12. Credit Sesame Affiliate Program

Credit Sesame offers free credit scores, monitoring, and personalized financial advice to help users manage and improve their credit health. Affiliates can earn commissions by promoting Credit Sesame's services, providing valuable tools to audiences seeking to enhance their financial well-being.

Credit Sesame Affiliate Program specs:

-

Commission: $3–$6 per approved sign-up

-

Cookie Duration: 30 days

-

Payment Method: Monthly payouts

-

Products: Free credit scores, credit monitoring, financial tools

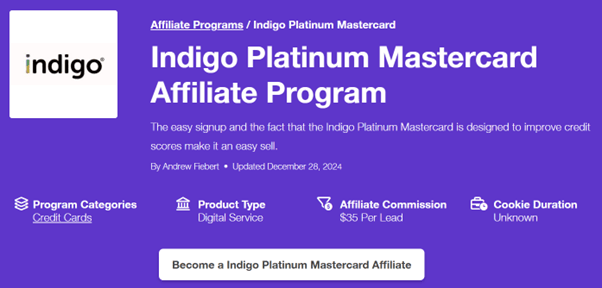

13. Indigo Platinum Mastercard Affiliate Program

The Indigo Platinum Mastercard is designed for individuals with less-than-perfect credit, offering an unsecured card without requiring a security deposit. Affiliates can promote this card to a broad audience seeking to rebuild their credit, benefiting from a straightforward application process and competitive commissions.

Indigo Platinum Mastercard Affiliate Program specs:

-

Commission: $35 per lead

-

Cookie Duration: 30 days

-

Payment Method: FlexOffers platform

-

Products: Indigo Platinum Mastercard

14. Owner’s Rewards Card by M1 Affiliate Program

The Owner’s Rewards Card by M1 offers up to 10% cash back on purchases with select brands, seamlessly integrating rewards into users' M1 investment portfolios. Affiliates can promote this innovative card to audiences seeking to enhance their investment returns through everyday spending, leveraging M1's comprehensive financial platform.

Owner’s Rewards Card by M1 Affiliate Program specs:

-

Commission: $70 per qualified funding, $50 per initial funding

-

Cookie Duration: 30 days

-

Payment Method: Impact affiliate network

-

Products: Owner’s Rewards Card by M1

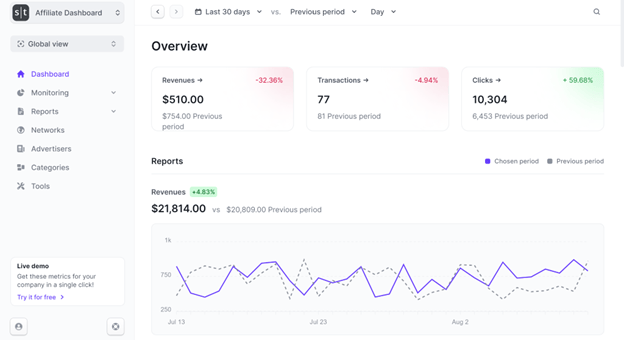

Why You Should Manage Your Credit Card Affiliate Programs with Strackr

Centralized Dashboard

With Strackr, you can consolidate data and metrics for all your credit card affiliate programs in one centralized dashboard. This makes it easy to track performance, identify trends, and make data-driven decisions for your affiliate marketing strategy.

Monitor Key Metrics

Speaking of metrics, Strackr gives you an unparalleled level of insight into the performance of your credit card affiliate programs. From click-through rates and conversions to revenue and commission, you have access to everything.

Plus, we make it easy to generate and share reports to keep any relevant stakeholders in the know.

Streamline Management

By consolidating credit card affiliate program data into a single platform, Strackr streamlines the management process. This helps you efficiently monitor and optimize your credit card affiliate marketing efforts. Less time on busy work means more time you can invest into growing your business.

Choose Strackr to Optimize Your Affiliate Marketing

There you have it—the eight best credit card affiliate programs of 2024.

Remember to always keep your readers' best interests at heart, not just by choosing the right program, but also providing value. After all, a happy reader today could mean tons of recurring revenue down the line.

Whether you choose to go for cashback cards or travel rewards, Strackr’s tools are here to help you manage your affiliate programs. Streamline your credit card affiliate efforts by connecting your affiliate networks today.

Share

Affiliate dashboard

Connect all your affiliate networks with Strackr to access to unified statistics and tools.

Try for free